Campaign Stories

Read through our collection of stories from all over the world about the powerful campaigns people are leading against fossil fuel financiers. Prepare to be inspired to take action in your own community!

Banks

Fossil Free Citi

Fossil Free Citi campaigns against Citibank, which is the second largest funder of fossil fuels in the world. Using research from the climate movement, campaigners uncovered that the bank has poured over $332 billion into coal, oil and gas since 2016, including $8.67 billion to companies developing fossil gas (LNG) projects globally and $1.78 billion to ConocoPhillips, the company behind the Willow oil drilling project on Alaska’s North Slope. Armed with this research, the campaign mobilizes grassroots organizers to pressure Citi to stop financing fossil fuel expansion and environmental racism, phase out financing for all fossil fuels, respect human rights, and massively scale up its investments in renewables and proven climate solutions.

asset managers

Vanguard S.O.S.

Vanguard S.O.S. is a global campaigning network of civil society organizations, social movements, and financial experts working to push Vanguard to shift its funds out of fossil fuels and move toward truly sustainable and responsible investing.

Vanguard is one of the largest asset managers in the world, and currently the world’s top investor in fossil fuels. It is one of the largest shareholders in nearly every public company in the U.S., giving it immense economic power. Instead of using this power to tip the world further towards climate catastrophe, we’re pressuring the company to use its influence for good and accelerate the transition away from fossil fuels.

TIAA-Divest!

TIAA-Divest! campaigns to pressure the $1.2 trillion retirement and financial services firm TIAA to divest from fossil fuels, and stop land grabs and deforestation. TIAA-Divest educates and mobilizes TIAA’s primary participants, higher ed and health industry professionals, to take action to stop TIAA’s investment in climate destruction.

Working with finance professionals and researchers like IEEFA and the Sunrise Project, TIAA-Divest! has uncovered the extent of TIAA’s fossil fuel assets as well as its ongoing greenwashing campaign. TIAA’s holdings include more than $78 billion in fossil fuel investments. TIAA has financed coal-fired power plants in the US and overseas and is one of the largest investors in Adani Ports, the notorious coal mining company. Our research also revealed that TIAA has ties to land grabbing and destructive industrial agricultural practices in the Brazilian Cerrado and other critical habitats around the world, routinely violating human rights.

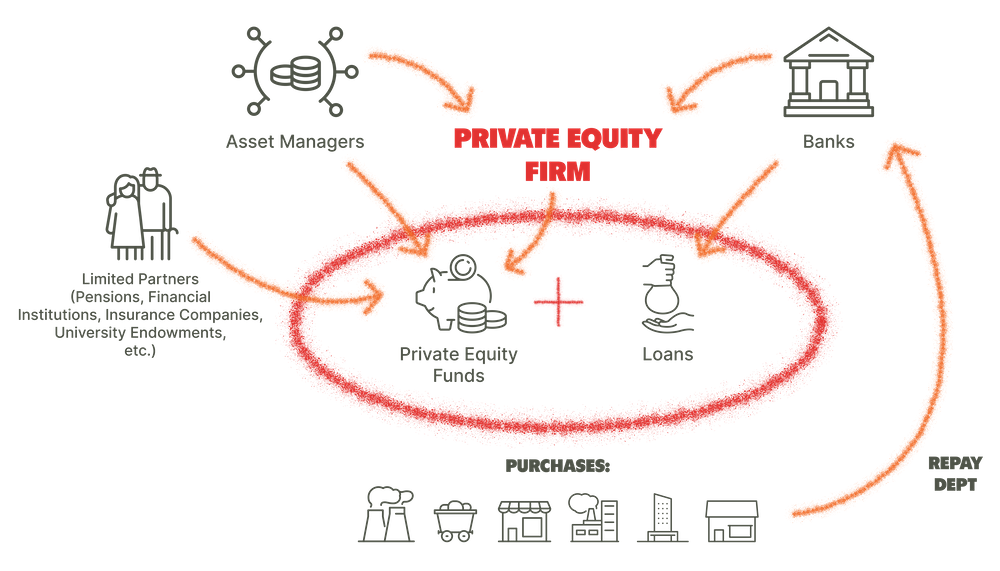

private equity

Private Inequity

Private Inequity is a global network of academics, investors, grassroots organizers, NGOs, climate activists and frontline communities working together to get private equity firms to stop investing in projects that drive climate change, perpetuate environmental racism, violate Indigenous rights, and cause harm to workers, neighborhoods, and local economies.

KKR

KKR is one of the largest private equity firms in the world. KKR promotes itself as a responsible corporate citizen while continuing to invest in dirty and harmful fossil fuel companies. Private Inequity is pressuring KKR to shift its energy investments to renewables and invest in real solutions that protect communities, biodiversity, and workers.

Coastal GasLink

Owned by KKR, AIMCo and TransCanada, Coastal GasLink pipeline is an LNG project that does not have free prior and informed consent (FPIC) from the Hereditary Chiefs of the Wet’suwet’en. Since KKR took ownership, there has been excessive use of force against land defenders including violent police raids. Private Inequity supports the Wet’suwet’en Hereditary Chiefs and the demands made to KKR executives to address the harms caused by the pipeline to waterways, salmon, forests, sacred historical sites and people.

Cameron LNG

A Sempra Infrastructure asset in which KKR is an investor, Cameron LNG is a $10 billion gas liquefaction facility and export terminal located in Hackberry, Louisiana. The project sits in the heart of one of the largest fossil fuel buildouts and has a history of environmental violations. Private Inequity is working with frontline community groups in the region voicing concerns about the facility’s impacts on the health of neighboring communities through air and water pollution.

Port Arthur

As of March 2023, KKR was the largest owner (approximately 45 percent) of the proposed large-scale LNG export terminal in Port Arthur, Texas. This terminal will increase the amount of toxic pollutants in the air and water, likely causing short- and long-term health problems for residents of the local community. Private Inequity is working with leaders of the Port Arthur Community Action Network who say the project will inflict more suffering on people who have little means to fight back against the billion-dollar companies dropping these projects into their communities.

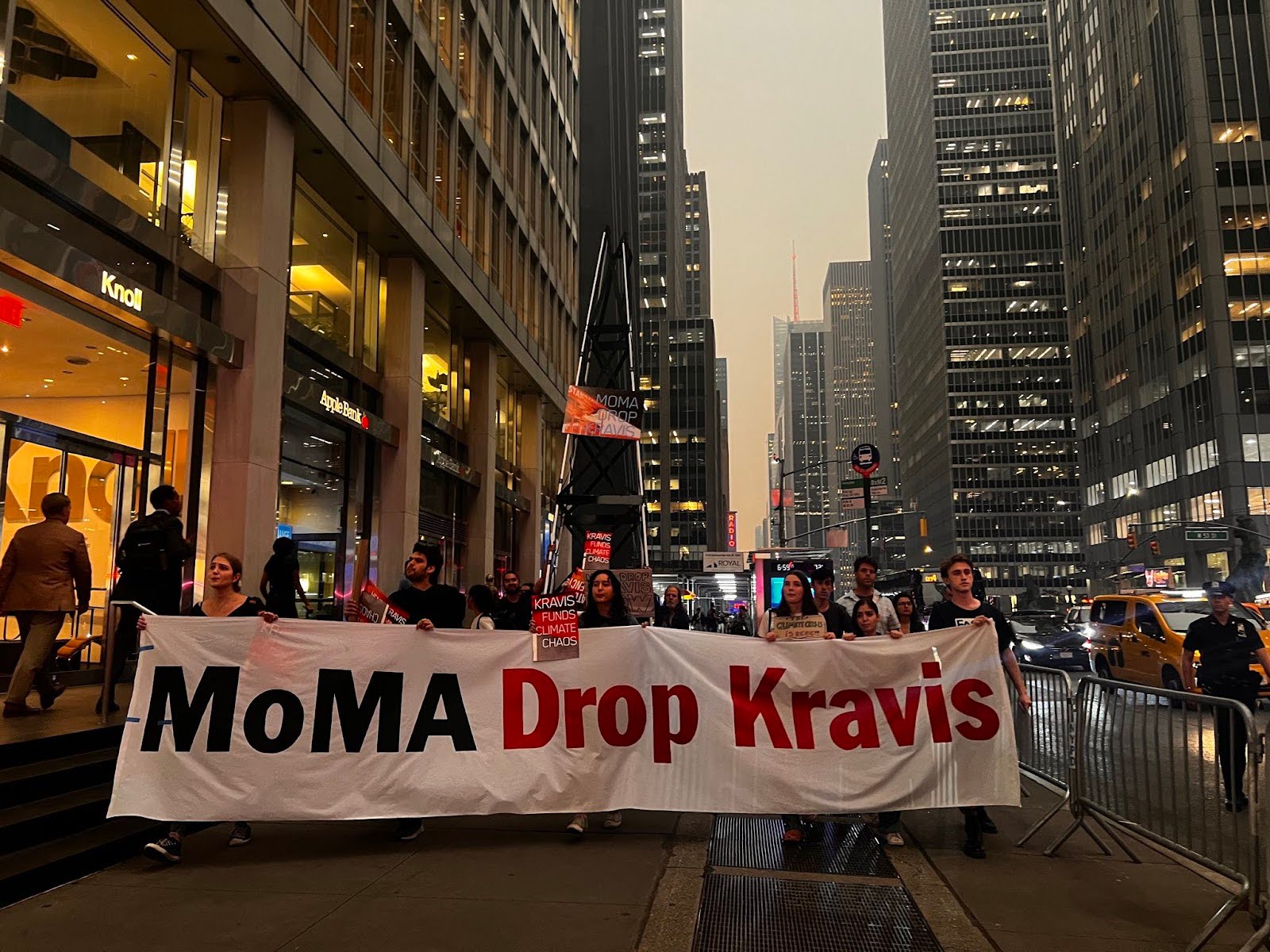

Private Inequity also holds KKR executives accountable for the firm’s actions. This includes the escalating protests at the Museum of Modern Art in New York due to deep connections to KKR co-founder and co-chairman Henry Kravis and his wife Marie-Joseé Kravis. The Private Inequity campaign, along with several climate activist groups, is calling on MoMA to cut ties with the Kravises due to KKR’s fossil fuel investments and destruction of communities. Learn more and sign the petition.

Rio Grande LNG

Private equity firm Global Infrastructure Partners (GIP) has a substantial $3.5 billion investment in Rio Grande LNG, making the firm the largest investor with a minimum 46% ownership stake in the project. In January 2023, Blackrock entered a deal to acquire GIP. If built, the project is estimated to emit the equivalent emissions of 44 coal power plants every year, about 163 million tons of carbon dioxide equivalent. Would significantly degrade local fishing, shrimping and natural tourism industries putting communities’ livelihoods at risk. Future global demand for LNG is also highly uncertain. The IEA forecast that demand for gas, oil and coal will all peak before 2030, and has noted that demand for gas growth has slowed considerably, leading to concerns about a “glut of LNG.” Sinking millions of dollars into massive gas infrastructure exposes investors to financial and environmental risks. Due to these environmental, social and financial risks advocates have urged pension funds across the US to urge GIP to meet with local communities and shut down the Rio Grande LNG terminal project. You can join South Texas communities in demanding GIP cancel the Rio Grande LNG project by sending an email to GIP leadership here.

General James M Gavin Coal Plant

The General James M Gavin Coal plant is owned by two major private equity firms, Arclight Capital Holdings LLC and The Blackstone Group. Major pension funds in Washington State, Oregon, California and New York all have significant investments in Blackstone’s Capital Partners VII fund thus exposing these pension funds to financial and environmental risk.

The Gavin Coalplant poses a significant environmental and public health risk to communities in the North East. The Gavin Coal plant is the ninth largest source of carbon dioxide emissions in the United States. Modeling by the Sierra Club estimated that Gavin causes 244 premature deaths per year from particulate emissions that increase the rate of heart attacks, asthma attacks, and other cardiovascular diseases.

While this coal plant harms local communities, it also poses a financial risk to investors such as pension funds. Coal demand is dropping and profits may follow. Analysts at IEEFA found that coal’s market share of domestic power production was below 20% in 2023 and demand for coal power in 2024 will likely continue to drop.

You can read more about the Gavin Coalplant and Blackstone here.

insurance companies

The Stop Adani Campaign

The campaign to stop the Adani Carmichael coal mine continues, as local Indigenous leaders call out the impacts on their land, air, water and sovereignty. Stop Adani was one of the first major fossil fuel fights to utilize insurance as a key lever in their fight, having astounding results. Through grassroots distributed organizing, the insurance campaign provided a key lever for folks to organize in international solidarity with those fighting coal. Over 40 global insurers ruled out providing insurance for Adani, and many created coal policies that prevent coal companies from accessing insurance all around the world.

The Stop Adani Campaign was wildly successful, here are some of the most noteworthy accomplishments

- Decreased to one sixth of it’s originally proposed size (at least in its initial phase)

- Been delayed by around 8 years

- Failed to secure any direct external finance, with over 100 major companies, publicly ruling out any direct association with the project

Stop EACOP

The East African Crude Oil Pipeline is a proposed pipeline that would stretch from Uganda to Tanzania, posing a massive threat of displacement and devastation to the communities and wildlife in its wake. Building the world’s longest heated crude oil pipeline is incredibly risky business – especially when it runs through an active seismic zone, like the EACOP will. Without insurance to “underwrite,” or cover that risk, the EACOP project will not move forward. Over 22 insurers have ruled out the pipeline, while others are, shockingly, still considering it.

Some of the most inspiring organizing have included mobilizations of thousands of people in direct action campaigns at insurers in Europe led by directly impacted Ugandan activists, and organizing with over 100 employees at the world’s largest insurance broker, Marsh to stop the insurance for the project. The campaign against the East African Crude Oil Pipeline is only growing in controversy and scale.

Fossil Fuel Finance Hub is a microsite of LittleSis, Rainforest Action Network, Private Equity Climate Risks and Vanguard SOS.