Private equity

How does private equity contribute to climate chaos?

Private equity firms are investment management companies that invest in and acquire private companies through capital raised from wealthy individuals and institutional investors, such as public pension funds and university endowments. Since they operate in the private markets, companies owned by private equity investors face less regulatory oversight than those of other financial actors, like big banks.

A few of the largest private equity firms are KKR, The Carlyle Group, Blackstone, Brookfield, Ares Management, Apollo, TPG Capital, and Warburg Pincus.

Private equity firms have invested over $1 trillion in energy since 2010, and thus have significantly propelled the climate crisis. Eight of the largest private equity buyout firms had 70 percent of their energy portfolios in fossil fuels in 2023.

The eight private equity firms profiled in the Private Equity Climate Risks 2022 scorecard collectively oversaw around $216 billion in energy assets, an amount similar to the fossil fuel financing of the world’s top five banks in 2021.

Private equity firms are busy buying up offshore drilling in the Gulf of Mexico, propping up fracking operations, prolonging dirty fuel usage by building infrastructure like pipelines and natural gas export terminals, and polluting through gas and coal power plants. In 2021 and 2022 private equity firms acquired at least $25 billion of oil and gas assets from the public markets. This is a continuation of a larger trend where oil and gas assets are transferred from public markets into the private markets thereby masking the emissions and their negative effects away from public view.

Want a deeper dive?

Read “How the Private Equity Power Structure Drives Climate Chaos” and learn how private equity firms plow billions into fossil fuel operations in their ruthless quest for profits.

How can we fight against private equity?

Private Inequity

Private Inequity is a global network of academics, investors, grassroots organizers, NGOs, climate activists and frontline communities working together to get private equity firms to stop investing in projects that drive climate change, perpetuate environmental racism, violate Indigenous rights, and cause harm to workers, neighborhoods, and local economies.

KKR

KKR is one of the largest private equity firms in the world. KKR promotes itself as a responsible corporate citizen while continuing to invest in dirty and harmful fossil fuel companies. Private Inequity is pressuring KKR to shift its energy investments to renewables and invest in real solutions that protect communities, biodiversity, and workers.

Coastal GasLink

Owned by KKR, AIMCo and TransCanada, Coastal GasLink pipeline is an LNG project that does not have free prior and informed consent (FPIC) from the Hereditary Chiefs of the Wet’suwet’en. Since KKR took ownership, there has been excessive use of force against land defenders including violent police raids. Private Inequity supports the Wet’suwet’en Hereditary Chiefs and the demands made to KKR executives to address the harms caused by the pipeline to waterways, salmon, forests, sacred historical sites and people.

Cameron LNG

A Sempra Infrastructure asset in which KKR is an investor, Cameron LNG is a $10 billion gas liquefaction facility and export terminal located in Hackberry, Louisiana. The project sits in the heart of one of the largest fossil fuel buildouts and has a history of environmental violations. Private Inequity is working with frontline community groups in the region voicing concerns about the facility’s impacts on the health of neighboring communities through air and water pollution.

Port Arthur

As of March 2023, KKR was the largest owner (approximately 45 percent) of the proposed large-scale LNG export terminal in Port Arthur, Texas. This terminal will increase the amount of toxic pollutants in the air and water, likely causing short- and long-term health problems for residents of the local community. Private Inequity is working with leaders of the Port Arthur Community Action Network who say the project will inflict more suffering on people who have little means to fight back against the billion-dollar companies dropping these projects into their communities.

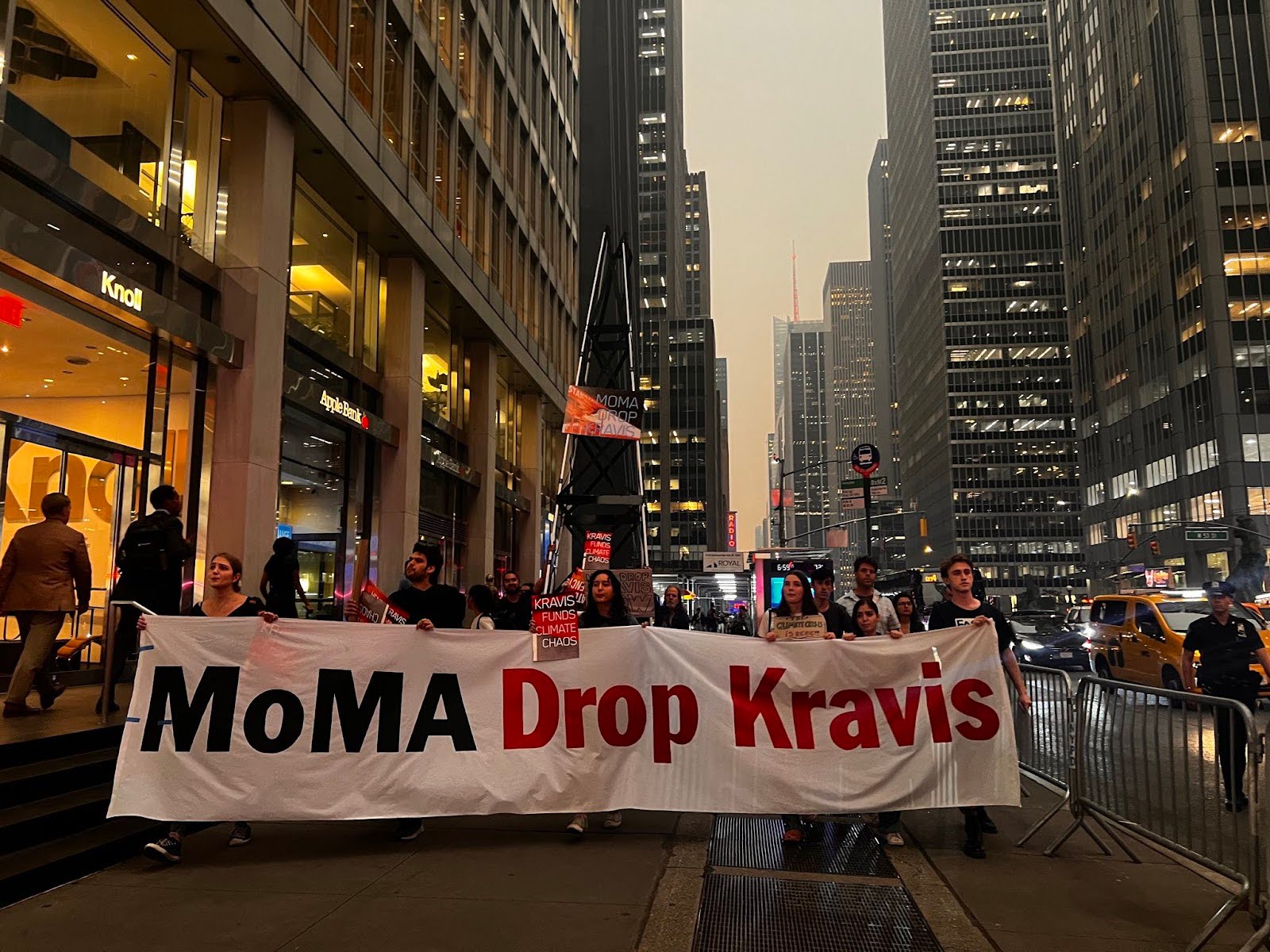

Photo Credit: Asya Pikovsky

Private Inequity also holds KKR executives accountable for the firm’s actions. This includes the escalating protests at the Museum of Modern Art in New York due to deep connections to KKR co-founder and co-chairman Henry Kravis and his wife Marie-Joseé Kravis. The Private Inequity campaign, along with several climate activist groups, is calling on MoMA to cut ties with the Kravises due to KKR’s fossil fuel investments and destruction of communities. Learn more and sign the petition.

Rio Grande LNG

Private equity firm Global Infrastructure Partners (GIP) has a substantial $3.5 billion investment in Rio Grande LNG, making the firm the largest investor with a minimum 46% ownership stake in the project. In January 2023, Blackrock entered a deal to acquire GIP. If built, the project is estimated to emit the equivalent emissions of 44 coal power plants every year, about 163 million tons of carbon dioxide equivalent. Would significantly degrade local fishing, shrimping and natural tourism industries putting communities’ livelihoods at risk. Future global demand for LNG is also highly uncertain. The IEA forecast that demand for gas, oil and coal will all peak before 2030, and has noted that demand for gas growth has slowed considerably, leading to concerns about a “glut of LNG.” Sinking millions of dollars into massive gas infrastructure exposes investors to financial and environmental risks. Due to these environmental, social and financial risks advocates have urged pension funds across the US to urge GIP to meet with local communities and shut down the Rio Grande LNG terminal project. You can join South Texas communities in demanding GIP cancel the Rio Grande LNG project by sending an email to GIP leadership here.

Photo Credit: Bekah Hinojosa

General James M Gavin Coal Plant

The General James M Gavin Coal plant is owned by two major private equity firms, Arclight Capital Holdings LLC and The Blackstone Group. Major pension funds in Washington State, Oregon, California and New York all have significant investments in Blackstone’s Capital Partners VII fund thus exposing these pension funds to financial and environmental risk.

The Gavin Coalplant poses a significant environmental and public health risk to communities in the North East. The Gavin Coal plant is the ninth largest source of carbon dioxide emissions in the United States. Modeling by the Sierra Club estimated that Gavin causes 244 premature deaths per year from particulate emissions that increase the rate of heart attacks, asthma attacks, and other cardiovascular diseases.

While this coal plant harms local communities, it also poses a financial risk to investors such as pension funds. Coal demand is dropping and profits may follow. Analysts at IEEFA found that coal’s market share of domestic power production was below 20% in 2023 and demand for coal power in 2024 will likely continue to drop.

You can read more about the Gavin Coalplant and Blackstone here.

How can we research the private equity firms financing fossil fuels?

The Private Equity Climate Risk Consortium’s Private Equity Energy Tracker

Explore a searchable list of recent energy holdings of eight of the top North American private equity firms

Private Equity Climate Risks 2024 Scorecard & Report

This scorecard and report reveals the top eight private equity firms invested in oil and gas and includes a set of demands to hold private equity accountable.

Private Equity Climate Risks Project

The Private Equity Climate Risks project investigates the role of the private equity industry in the climate crisis.

Private equity snaps up billions more in fossil fuel assets

Read about how PE firms bought at least $25 billion in fossil fuel assets from public markets, KKR grabs biggest deals

Private Equity Propels the Climate Crisis

Read about the risks of a shadowy industry’s massive exposure to oil, gas and coal.

Climate Finance Regulation Hub

A resource hub for anyone interested in learning more about climate finance regulation, published by members of the Stop the Money Pipeline coalition.

Fossil Fuel Finance Hub is a microsite of LittleSis, Rainforest Action Network, Private Equity Climate Risks and Vanguard SOS.